Know what’s best for you

Ans 1 - There are many factors that affect your monthly investments. Meet us and

know which amount works perfect for you.

Ans 2 - You need to calculate your and your loved ones goals for finding this answer.

We will thoroughly study these to find what will work for you.

Ans 3 - There’s no ‘one fit for all’ in investment. A lot more needs to be considered. Say

hello to us, consider these and begin investing.

Ans 4 - To calculate your growth in investment, you need goals. They help you in

counting factors that matter to you. Know more, connect with us.

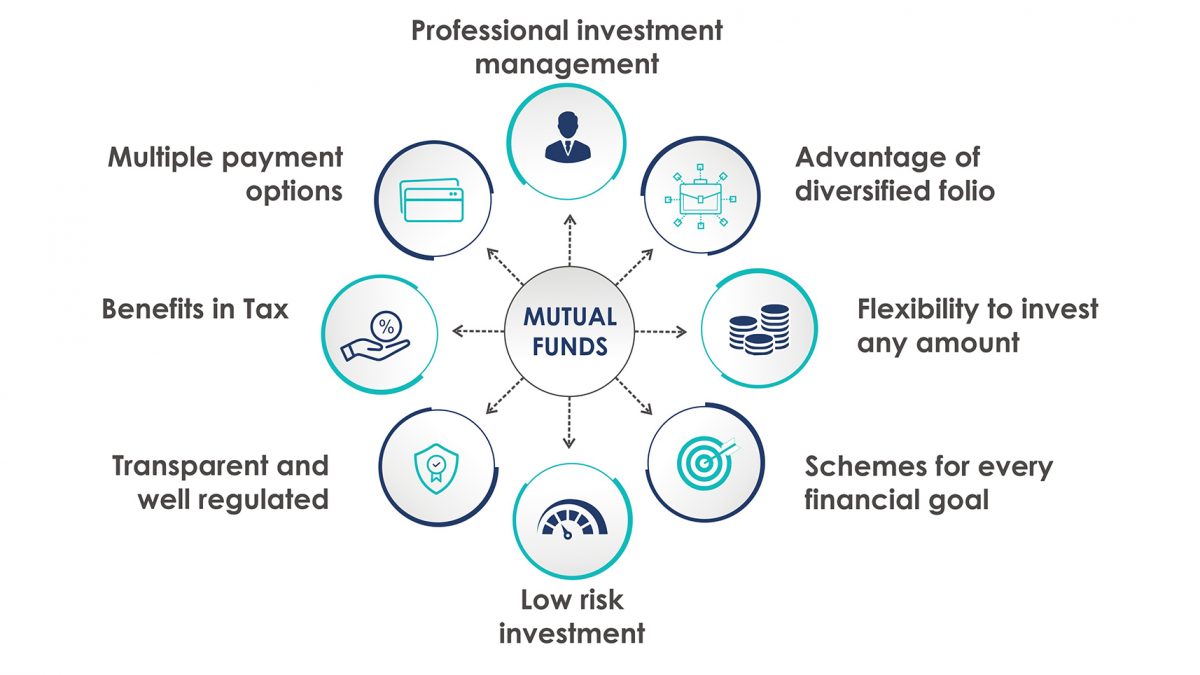

Mutual Funds are not a new concept. In fact, for some, they are synonymous with investing. However, they’re just a part of an investment portfolio. When you decide to invest in Mutual Funds, we will help you answer some of the crucial questions like which scheme to choose, how would they meet your goal or even why you should opt for Mutual Funds Investment.

Widely famous, mutual funds pool investment from several investors to invest in capital assets. As an investor, you can buy mutual fund 'units' - your share of holdings in a particular scheme. These units can be purchased or redeemed any time at the fund's current Net Asset Value(NAV).

All mutual funds are registered with SEBI and function within its provisions.

An equity fund is a mutual fund scheme that invests predominantly in equity stocks. There are equity funds of every type and characteristic available to match every risk profile and investment objective for the investors.

Large Cap Equity Funds invest a large portion of their corpus in companies with large market capitalization. These funds offer stability and sustainable returns, over a period of time.

Mid-Cap Equity Funds invest in stocks of mid-size companies, which are still considered developing companies. They tend to offer more growth potential than large-cap stocks.

Small Cap Fundsi nvest in stocks of companies with a relatively small market capitalization. Small-cap stocks tend to be more volatile (and therefore, riskier) than large-cap and mid-cap stocks.

Thematic Equity Funds invest in securities of specific sectors. These funds may give higher returns, but they also come with increased risks.

A debt fund is a mutual fund scheme that invests in fixed income instruments, such as Corporate and Government Bonds, etc. They are also referred to as Income Funds or Bond Funds. Debt funds are ideal for investors who want regular income, but are riskaverse.

Gilt funds

These funds invest only in government securities. They do not carry a credit risk - where the issuer of the security can default and are preferred by investors who are risk averse. However, they are subject to high interest rate risk.

Liquid Funds invest predominantly in highly liquid money market instruments and debt securities of very short tenure and provide high liquidity. When investors wish to park their money for short periods, typically 1 day to 3 months, they can opt for investing in Liquid Funds.

These funds invest in a mix of both stocks and bonds in various combinations. Hybrid Funds are also called marginal equity funds, or asset allocation funds. They are preferred by low-risk investors or new investors who are unsure about stepping into the equity markets.

Balanced Funds

A balanced fund combines equity stock component, a bond component and sometimes a money market component in a single portfolio. These funds invest in a mix of equities and debt. This way the investor can make the most of each component. They are ideal for investors who are looking for a mixture of safety, income and modest capital appreciation.

ETFs are traded on indexes such as CNX Nifty or BSE Sensex, etc. When you buy shares/units of an ETF, you are investing in a portfolio that tracks the yield and return of its native index. The main difference between ETFs and other types of index funds is that ETFs do to beat the market, they try to be the market.

ETFs typically have higher daily liquidity and lower fees than mutual fund schemes, making them an attractive alternative for individual investors.

A Gold ETF aims to track the domestic physical gold price. They are traded on the National Stock Exchange of India (NSE) and Bombay Stock Exchange Ltd. (BSE) like a stock of any company.

Gold ETFs combine the flexibility of stock investment and the simplicity of gold investments.

ELSS means Equity linked saving scheme. ELSS is an equity mutual fund investment that invests at least 80% - 100% of its assets in equity and equity-related instruments. Investments in an ELSS qualify for tax deductions under Section 80C of the Income Tax Act. Investments in ELSS are subject to a three-year lock-in period.

Learn more about mutual funds in a simple manner with us. Make apt investment choices. We will research and find the schemes that fit your investment goals. All you need to do is - choose where to invest and how much.

Mutual fund investments are subject to market risk. Past performance may or may not be sustained in the future. Please read all scheme related offer documents carefully before you make your investments decision. M2M Financial P. Ltd. or any member of the organisation does not suggest or claim any investments schemes or it's returns out of your investments. Any indicative returns or future value chart on the website is only for illustrative purposes based on past performance. It does not mean or claim as future guaranteed return or value. Any content on the website is just for reference purposes and does not claim any current or future responsibility. Visitors to this website must use it as a reference only and evaluate it with various parameters related to the subject.